Updated: October 11, 2025 to incorporate GE's response.

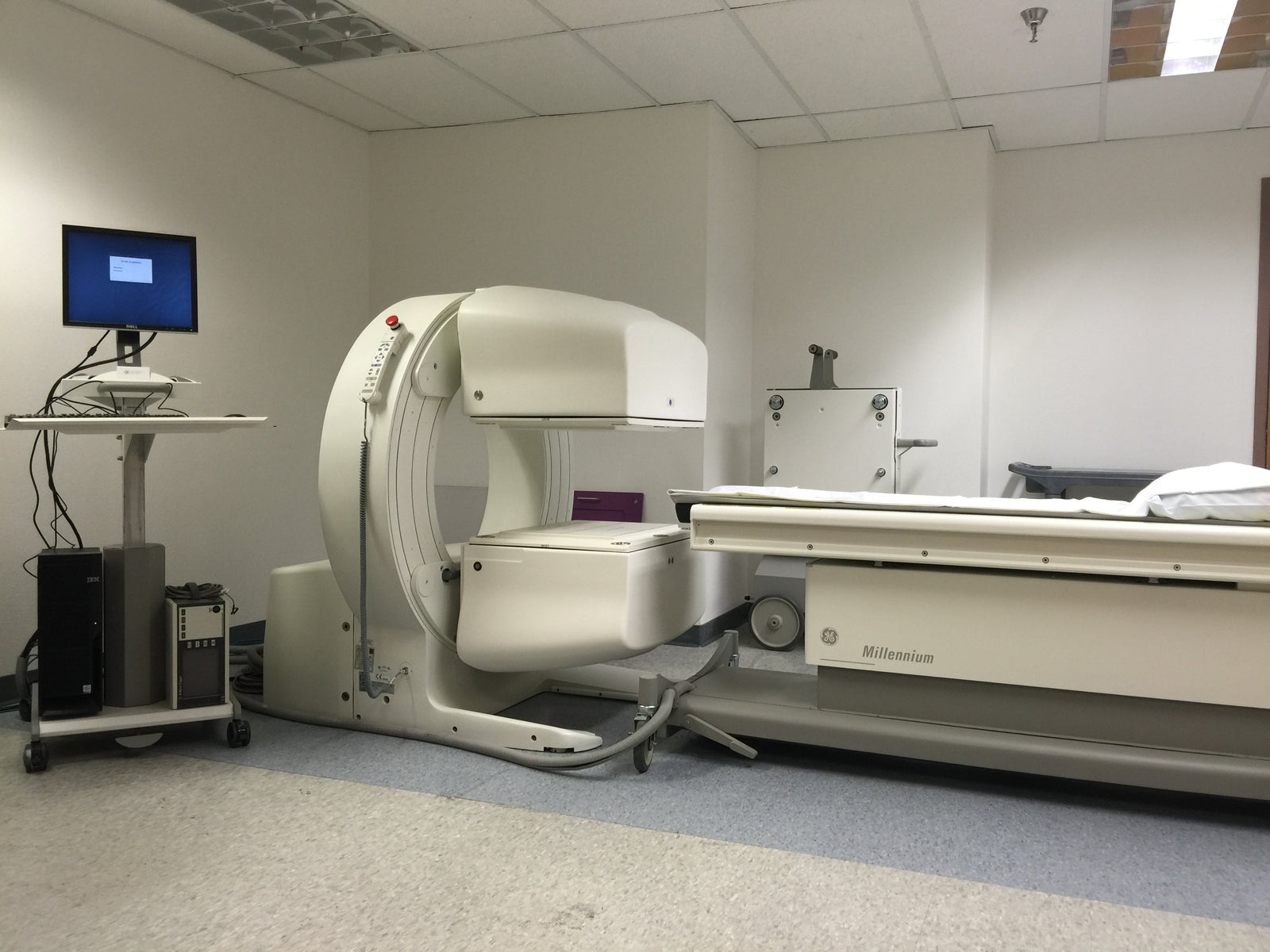

In a telling display of post-spin-off priorities, GE HealthCare issued an urgent “stop use” notice on September 12, 2025, for aging nuclear medicine systems. The directive, reference #40909 and signed by Chief Quality & Regulatory Officer Laila Gurney and Chief Medical Officer Scott Kelley, warns of “life-threatening bodily injury” from potential detector falls. It targets models like the Elscint Cardial, Millennium VG, and Starcam—devices past their “End of Guaranteed Service.”

Yet, the focus lands squarely on the still-prevalent Millennium MG and Myosight systems, unlike the scarcer models listed. Despite no reported incidents, the notice demands immediate shutdown, vague decommissioning aid, and a pitch for “replacement options” via GE reps.

This hands-off approach contrasts sharply with the 2018 response, where GE offered free inspections and repairs for identical risks on the Millennium models. Now, as a standalone public entity fixated on shareholder returns—highlighted by a $1 billion share repurchase program in Q1 2025—GE seems to be slashing legacy support costs to inflate profits, stranding hospitals and endangering patients.

The risk, however, appears exaggerated; the lone documented detector fall involved an Infinia Hawkeye 4 in 2013, suggesting this “urgent” move may prioritize corporate interests over evidence-based safety.

A History of Hazards: From Fixes to Financial Abandonment

GE HealthCare’s nuclear medicine devices have a decade-long track record of detector detachment risks, underscoring persistent design vulnerabilities. In 2013, a 550-pound gamma camera from the Infinia Hawkeye 4 crushed a 66-year-old patient to death at a New York VA hospital, triggering a Class I FDA recall for 1,400 global systems. GE intervened with cost-free inspections and repairs, yet no public settlements materialized, fueling accountability concerns.

By 2018, the Millennium MG, MC, and Myosight—central to the 2025 notice—faced similar scrutiny. On September 14, 2018, GE initiated a Class I recall (reference #40878) after identifying a detector detachment risk due to a motion subsystem error and missing mechanical stopper, posing a “life-threatening bodily harm” threat if a fall occurred during a patient exam. Without any injuries noted or even a reported mechanical incident absent a patient, GE proactively inspected and repaired all affected units worldwide at no cost to customers, completing field actions by November 2018 and terminating the recall in October 2020. This customer-centric approach stands in stark contrast to 2025’s abrupt “stop use” order.

The pattern persisted in 2023 with another Class I recall for the 600/800 Series, where 1,212-pound detectors risked falling due to ball screw failures. GE pledged inspections for supported models, excluding older acquired lines from Elscint and Sopha.

Now, in 2025, GE attributes risks to “transported or relocated without adequate detector support” causing “excessive stress” on mounting mechanisms, declaring it “does not have the ability to correct these devices” and labeling this the “final communication.” A required acknowledgement form builds a liability shield—if incidents occur post-warning, blame shifts to users. The 2023 spin-off of GE HealthCare from GE, designed to “unlock long-term shareholder value” via streamlined operations, appears pivotal. CEO Peter Arduini has touted “strong long-term business prospects” through buybacks and dividends, navigating a $500 million tariff threat with supply chain adjustments—all while trimming service commitments and staff.

Behind the Safety Screen: Profits Over People

While the notice nods to FDA compliance under 21 CFR Part 803, its motives scream self-preservation. The Millennium models, remediated in 2018, are now “no longer serviceable” beyond Guaranteed Service, prompting GE’s exit. Absent post-2018 injuries, the “urgency” likely arises from internal reviews or unreported close calls, forestalling litigation akin to the hushed 2013 aftermath.

The profit angle dominates: Q1 2025 earnings flaunted 3% revenue growth and 10% order increases, triggering the $1 billion buyback to “return capital to shareholders.” Q2 uplifted guidance amid “healthy customer investment,” halving tariff impacts via relocations—at possible supply risks. 2024’s full-year touted 2% organic growth and 98% cash conversion, priming 2025 for “driving long-term value.” The “replacement options” pitch reeks of salesmanship against competitors like Siemens and Philips, converting safety lapses into upgrades while axing support expenses. Observers highlight how such tactics “pivot” clients to premium products, morphing crises into cash flows—all to elevate EPS and repurchases.

Detractors see this as emblematic of medtech flaws: Class I designations flag mortal dangers, but GE’s reactive timeline—bolstered by recent Class II recalls on Varicam and Millennium VG—reveals profit-fueled inertia. Tariffs, eyed at $375 million from China-U.S. ties, are offset by shifts, underscoring margin defense over device durability.

The Human Toll: Hospitals Hamstrung, Patients at Risk

Healthcare providers face disruption: These systems are crucial for cancer, heart, and neuro scans, and sudden halts—especially for prevalent Millennium models—could delay diagnostics in resource-strapped facilities. Yet, amidst fears of losing GE’s service support, relief comes from third-party independent service organizations (ISOs) such as Quality Diagnostic Imaging (NuclearCamera.com) and others, which provide readily available parts and service. [Retraction: GE Healthcare asserts no viable fix exists due to complex failure modes, and this claim is under review pending further details. See 'GE Healthare's Response' below.] GE’s “assistance” lacks funding, forcing hospitals to bear decommissioning and upgrade costs amid tight budgets.

Patients bear the brunt: Recurring fall threats conjure horrors of mid-scan crushes. As GE trumpets “high level of safety and quality,” its refusal to extend 2018-style fixes for still-useful devices reeks of abandonment.

GE HealthCare’s Response and Open Questions

On October 8, 2025, GE HealthCare, via legal counsel at Sidley Austin LLP, responded to this post, asserting it contains “misstatements” that could undermine their Urgent Medical Device Correction (UMDC) #40909 (issued Sept 12, 2025). They emphasize this is a regulated recall with FDA-submitted documentation, citing a “documented safety issue” (potential bolt failures from transport stress) with no validated fix for End of Guaranteed Service (EOS) systems. GE argues that suggesting continued use or ISO repairs is inaccurate, as invasive teardown—risking new hazards—is required, and no incidents don’t negate the risk.

This author acknowledges GE’s safety focus and revises the ISO claim accordingly. The prior statement about ISOs as a “viable alternative” is updated: GE claims no fix exists due to complex, non-visible failure modes requiring teardown, which may exceed ISO capabilities; further details are needed. No patient injuries or mechanical incidents have been reported for Millennium MG/MyoSIGHT post-2018 (per FDA MAUDE, Oct 9, 2025), but theoretical risks justify caution.

To ensure accuracy, I requested GE address:

1. Are there non-invasive inspection protocols GE could share publicly to assess risk pre-shutdown?

2. What financial or logistical support is available for disposal to minimize costs for small/rural facilities?

3. A clear identification of which bolts are the failure point for the GE Millennium systems (e.g., tub-to-tub ‘U’ bracket under epoxy)?

4. How does this failure scenario apply across diverse UMDC models with varying equipment designs?

5. When was this risk first identified, and what process led to its discovery on EOS systems?

6. We’ve received unconfirmed reports that some customers may have received exemptions from this stop use request. Can you clarify?

7. We’ve heard unconfirmed reports of a 4-6 week lead time for large quantity orders and ramped production. Would GE care to comment?

GE HealthCare’s Reply (October 11, 2025)

Mr. Basterash,

Thank you for your response. We are writing on behalf of GE HealthCare and, while we continue to disagree with your characterization of the recent action regarding certain GE HealthCare Nuclear Medicine systems, we want to specifically address three key topics you raise in your response.

First, no customers with a device within scope of the recall have received exemptions.

Second, with regard to your technical questions, for the reasons described in our initial letter, GE HealthCare does not have the ability to inspect or correct the devices, or to provide a validated method that can be followed by others to inspect or correct the devices.

Finally, as the UMDC indicates, if a customer requires assistance in removal and disposal of their system, they should contact their local GE HealthCare representative. If a customer would like to discuss replacement options, they should contact their GE HealthCare account representative.

We appreciate your interest in providing accurate information.

Very truly yours,

Raj D. Pai & Mark P. Guerrera

RAJ D. PAI

SIDLEY AUSTIN LLP

+1 202 736 8089

rpai@sidley.com

GE’s full letter, dated October 8, 2025, is hyperlinked below. Their October 11 response is featured above. Unanswered questions (#1, #2, #3, #4, #5, #7) will be pursued in a follow-up. Until then, hospitals should review the UMDC while exploring support options, including ISOs, pending clarification. This update, posted October 11, 2025, at 08:24 AM CDT and revised at 12:45 PM EDT, reflects GE’s input.

GE HealthCare Letter, October 8, 2025

Demanding Better: When Will Patients Come First?

GE HealthCare’s 2025 notice averts immediate crises but exposes a profit-over-people ethos. Post-spin-off, shareholder perks like buybacks and dividends thrive while customers scramble. As FDA classifications mount, it’s time for regulators to enforce audits, extended guarantees, and penalties for recidivists. Until then, GE’s “final” edict underscores a harsh truth: In medtech’s boardrooms, shareholders reign supreme, leaving customers—and lives—secondary. For the Millennium MG/Myosight, where no detector fall has ever been recorded, this feels like exploiting an inflated risk to bolster corporate bottom lines.

by: Jeremy Basterash, COO, QDI, LLC, with assistance from Grok, created by xAI